Driven by technological innovation, the industrial landscape is reshaped.

In today's digital age, electronic components, as the fundamental components of electronic devices, are undergoing profound changes and developments. In 2025, the electronic components industry will witness a parallel trend of technological innovation and supply chain reconstruction, bringing new opportunities and challenges to the entire technology sector.

The market size continues to expand, and China leads the growth momentum

The global market size of electronic components is expected to exceed 800 billion US dollars in 2025, demonstrating a strong growth momentum. Among them, the scale of the Chinese market will reach 19.86 trillion yuan, with a compound annual growth rate of 10.6% compared to 2020, becoming an important driving force for global market growth. This growth benefits from the surging demand in multiple fields.

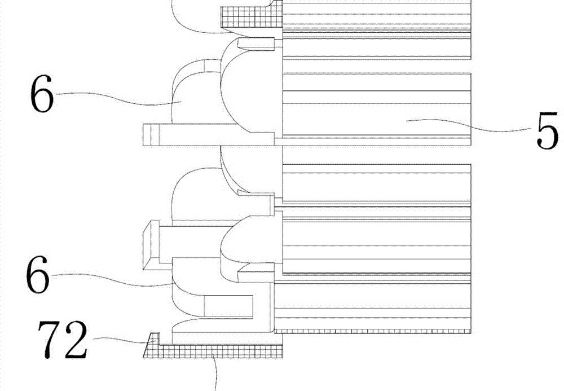

In the fields of artificial intelligence (AI) and 5G communication, NVIDIA's AI chips saw both volume and price increase throughout the year, while SK Hynix's HBM memory was in short supply, highlighting the urgent need for advanced electronic components in high-performance computing and high-speed communication. The explosion of new energy vehicles has also injected strong impetus into the electronic components market. The withstand voltage level of automotive-grade IGBT modules has exceeded 1700V, and the conversion efficiency has reached 99.3%, which has promoted the improvement of electric vehicle performance and also driven the growth in demand for related electronic components. Furthermore, the recovery of the consumer electronics market, especially the popularity of smart wearable devices, has led to a 34% increase in the demand for micro electro-acoustic components (such as microphones and speakers).

Technological breakthroughs reshape the industrial landscape

Innovation in materials and processes

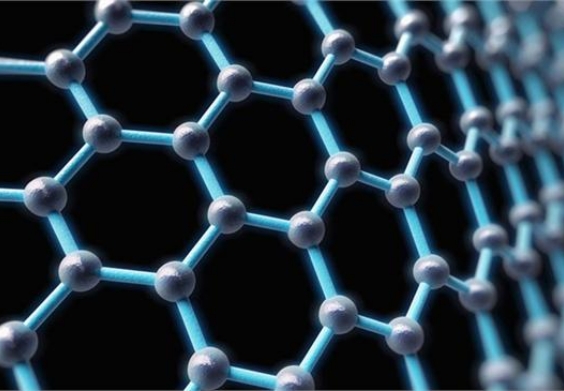

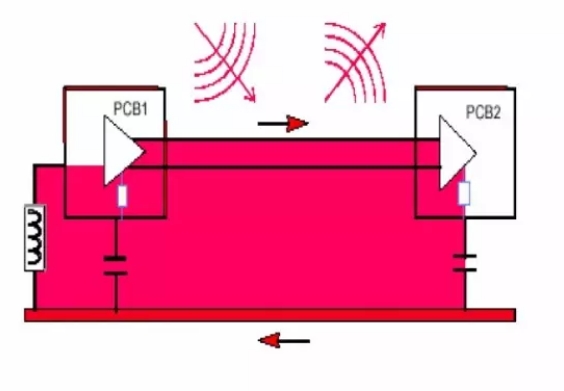

The rise of the third-generation semiconductors: Silicon carbide (SiC) devices have increased the charging efficiency of electric vehicles by 30%, and gallium nitride (GaN) radio frequency devices have a penetration rate of over 60% in 5G base stations. The third-generation semiconductors, with their outstanding performance, are gradually replacing traditional silicon-based devices and playing a key role in fields such as new energy vehicles and 5G communications.

Miniaturization limit breakthrough: 3D NAND storage chips achieve 232-layer stacked mass production, with a chip the size of a fingernail having a capacity of up to 1TB. With the pursuit of miniaturization and high performance in electronic devices, the trend of miniaturization of components is becoming increasingly obvious. The development of 3D stacking technology provides the possibility of achieving higher-density storage.

Intelligent manufacturing upgrade: The recognition accuracy of the AI optical inspection system reaches 0.01mm, and the speed of the surface mount technology (SMT) machine exceeds 200,000 points per hour. The application of intelligent manufacturing technology not only enhances production efficiency, but also improves product quality and consistency, and reduces production costs.

The acceleration of domestic substitution

The domestic production rate of MLCC (multilayer ceramic capacitors) in China has risen from 8% in 2018 to 25% in 2025, but the self-sufficiency rate of high-end photoresist is still less than 5%. With the support of national policies, domestic enterprises have increased their investment in research and development and actively promoted the domestic substitution of key electronic components. Fenghua Hi-Tech has collaborated with Weiyang Technology to build a digital supply chain, reducing the spot delivery cycle by 40% and providing strong supply chain support for domestic substitution.

Supply Chain Challenges and Response Strategies

Risks in the global game

The United States has upgraded its semiconductor control over China, and the European Union plans to impose additional tariffs on electric vehicles. The average delivery time for automotive-grade chips still exceeds 30 weeks. Global trade frictions and geopolitical factors have brought many uncertainties to the electronic component supply chain. In addition, the problem of counterfeit components has led to a 15% increase in the quality cost of enterprises, seriously affecting the healthy development of the industry.

Industry response measures

Supply chain diversification: Enterprises are seeking supply chain diversification one after another. The proportion of procurement from Europe/Southeast Asia has increased to 28%, in order to reduce reliance on a single region and enhance the resilience of the supply chain.

Digital empowerment: Big data analysis tools predict component price fluctuations with an accuracy rate of 92%, helping enterprises better respond to market changes and optimize procurement strategies.

Policy support: China's "Two New and Two Major" policies have driven a 50% increase in R&D investment in domestic IGBT modules, providing policy guarantees for technological innovation and industrial upgrading of domestic enterprises.

Future trend: Integration of innovation and ecological reconstruction

Practical application of quantum technology: Superconducting single-photon detectors achieve 150-kilometer quantum communication transmission. The development of quantum technology will bring brand-new application scenarios to electronic components and promote the development of fields such as quantum communication and quantum computing.

Bioelectronic breakthrough: The in-body working life of degradable flexible sensors has been extended to 180 days, promoting the development of smart healthcare. The advancement of bioelectronic technology has enabled electronic components to better integrate with biological systems, bringing innovative solutions to the medical and health field.

Green manufacturing: The low-temperature co-fired ceramic (LTCC) technology reduces energy consumption by 40%, and the bending life of nano-silver wire conductive ink exceeds 200,000. With the enhancement of environmental awareness, green manufacturing has become an important trend in the development of the electronic components industry. By adopting environmentally friendly materials and energy-saving processes, sustainable development can be achieved.

In 2025, the electronic components industry is at a critical juncture of technological innovation. The continuous expansion of the market scale, the constant breakthroughs in technology, and the reconstruction of the supply chain will all lay a solid foundation for the future development of the industry. Against the backdrop of increasingly fierce global technological competition, the innovation and development of the electronic components industry will have a profound impact on the entire technology industry.